|

best medical insurance for dogs: a clear, proof-first guideWhat "best" really meansThe best plan protects against catastrophic bills, pays quickly on clean claims, and stays affordable as your dog ages. Not fancy perks - reliable math. - Coverage breadth: accident and illness, hereditary and congenital, cancer, imaging, rehab, and dental illness.

- Payout reliability: reimbursement based on the actual vet bill, not a fee schedule.

- Speed: predictable claim timelines and transparent status updates.

- Stability: premiums that don't spike unpredictably; clear renewal terms.

- Fit: limits and deductibles aligned with your emergency cash and your dog's risk.

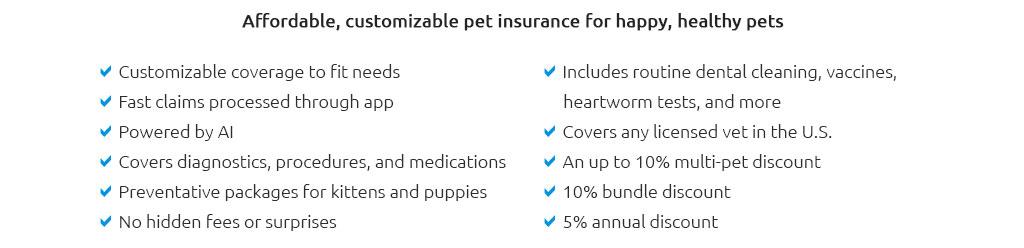

Core features to insist on- Accident + illness as the base. Wellness add-ons are optional.

- Hereditary and congenital conditions covered with no breed carve-outs.

- Dental illness (not just accidents) including extractions and root canals.

- Exam fees for covered incidents included.

- Chronic conditions covered across policy years without reset.

- Orthopedic issues covered, with reasonable cruciate/hip waiting periods and no bilateral traps.

- Oncology care: chemo, radiation, advanced meds.

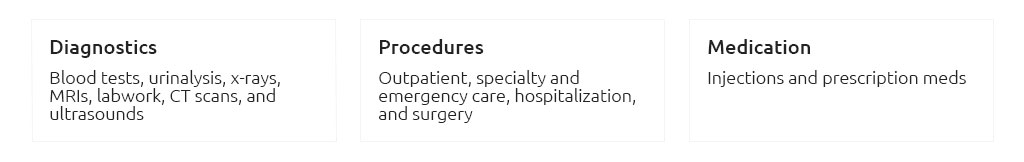

- Diagnostics: CT/MRI/ultrasound and pathology.

- Rehab and alternative care: PT, acupuncture, hydrotherapy.

Wellness can look attractive. Second thought: it mostly pre-pays routine care; choose it for budgeting, not value. Numbers that anchor reality- Premiums: roughly $35 - $100+ per month depending on breed, age, and region.

- ACL/CCL surgery: $3,000 - $5,000 per knee.

- GDV (bloat): $1,500 - $3,000+.

- Cancer treatment: $6,000 - $12,000+ across a course.

- ER visit with overnight: $1,200 - $2,500.

- Advanced imaging: $400 - $1,200 each study.

- Long-term meds: $30 - $120 per month.

Example: surgery billed at $4,000 with 80% reimbursement and a $500 annual deductible. Insurer pays 80% of $3,500 = $2,800. You pay $1,200. One event can offset years of premiums. Proof checklist you can verify- Request a sample policy; read exclusions and definitions of "pre-existing" and "clinical signs."

- Confirm reimbursement is against the actual invoice, not a fee schedule.

- Check limits: annual at least $10k; no per-incident micro caps; unlimited if you want zero cap risk.

- Ask for median claim turnaround and the 90th percentile (not just "fastest").

- Review complaint ratios and renewal increase history; seek transparent age-based pricing.

- Verify direct-pay or e-payment options for large ER bills.

- Note waiting periods: standard illness, orthopedic specifics, and any bilateral clause.

- Confirm coverage of exam fees, dental illness, rehab, and prescription meds.

- Run a 5-year scenario with expected premiums plus one major event and two minor claims.

- Have your vet glance at coverage for your breed's known risks.

A quiet real-world momentApril, 7:40 p.m. My terrier mix yelped, then wouldn't bear weight. ER, radiographs, splint, meds: $2,436. Deductible $250, 80% reimbursement. Net out-of-pocket $738. Funds arrived on day six. Chaos turned into a process - and that's the point. Deductible, limit, coinsurance: choose with intentPick the highest annual deductible you can comfortably pay that day. 80% reimbursement often balances cost and protection; 90% if you prefer smaller surprises. Annual limit of $10k covers most years; unlimited removes ceiling risk. First thought: unlimited is always best. Second thought: if you keep a modest emergency fund and your dog's risk is average, a solid $10k limit with broad coverage may be the sweet spot. Pre-existing, waiting periods, and clauses that bite- Any noted sign - even "mild limp" - can be deemed pre-existing later.

- Cruciate and hip waiting periods vary; get them in writing.

- Bilateral clauses can exclude the second knee if the first had issues.

- Breeding, cosmetic, and elective procedures are typically excluded.

- Parasites, special diets, and grooming are usually not covered.

- Working or sporting dogs may face special exclusions.

Red flags- Fee schedules or "usual and customary" caps instead of actual bill reimbursement.

- Low per-incident sublimits hidden in the fine print.

- Premium hikes unexplained or spiking far above age-related trends.

- Exam fees excluded for covered incidents.

- Clunky claim submission and vague timelines.

Decide in three passes- Shortlist three policies that meet the coverage essentials.

- Price a catastrophe and two minor events; compare 5-year totals.

- Choose, enroll, and set a reminder to re-check pricing in 18 - 24 months.

If you skip insuranceAutomate a monthly vet fund, keep a low-interest medical credit option ready, ask for itemized estimates, and use generics when appropriate. Discipline required. Bottom lineThe best policy pairs broad coverage with honest math and fast payouts. Decide on proof, not promises. Your dog gets care; you keep control.

|

|